Changing Winds – New Windfall Gains Tax Introduced In Victoria

Set to be introduced from 1st July 2023, The Victorian State Government’s new Windfall Gains Tax will address land value increases due to government led land rezoning in Victoria. In simple terms, the new tax will mean that if the land you own is rezoned and increases in value, you may be taxed on the value uplift. This tax will apply only to land that is rezoned after 1st July 2023 and applies to all land in Victoria.

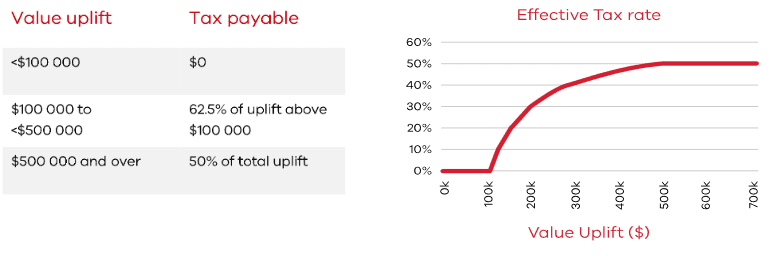

Tax Rates

A tax-free threshold of $100 000 will ensure that only landholders experiencing a significant uplift will be impacted. The tax will be calculated based on valuations undertaken by the Valuer-General Victoria on the pre-zoning and post-zoning value of the land based on the Capital Improved Value.

Exemptions

Several exemptions and exclusions will apply to the Windfall Gains Tax including a ‘Residential Land Exemption’. For each land rezoning, up to two hectares of ‘residential land’ owned by the same owner or group will be exempt from the windfall gains tax. Residential Land in this case is defined as land (including primary production land) that has a building affixed to it for primarily residential purposes.

Other exemptions include land already subject to Growth Area Infrastructure Contributions (GAIC), charitable land, university land, land rezoned to Public Land Zone and land rezoned to a Rural Zone.

Who Pays?

Generally it is the owner of the land at the time of the rezoning that pays the Windfall Gains Tax. It must be noted that landowners should be aware of the tax when entering into sale contracts where rezoning is a possibility, especially long-term contracts as dealing with the risk of Windfall Gain Tax before settlement without making sure the purchaser is required to pay the tax could be costly.

What Does This Mean For NSW?

Like Victoria, New South Wales is also introducing value capture type reforms. In October 2021 the NSW Government proposed reforms to the system of Infrastructure Contributions in New South Wales. These proposed NSW property tax reforms will apply to increased land values that occur through rezoning or government infrastructure investment. Unlike Victoria, these taxes are to be paid at a fixed rate depending on the project and location, with the system applying statewide. In 2022 however, the legislation was put on hold before Parliament. An amended package will be introduced to the NSW Parliament sometime this year. How these reforms will compare to the Victorian system and what changes can be expected for property owners in New South Wales, we will have to wait and see.